In less than 24 hours a major Wall Street Investment

Firm (that seemed awfully like Lehman Brothers) jolts from success to near

death in a story that would have been inconceivable before this current financial

free fall started in 2008 … or maybe

not.

The meltdown starts when in the midst of a round of

cost-cutting redundancies Eric, a senior

risk analyst is laid off and as he is being immediately escorted off premises,

he passes a USB drive to Peter one of his younger colleagues who has still got

a job. His parting words are to tread

very carefully with the information that it contains, and he does. Whilst the rest of the staff on his Trading

Floor adjourns to a Bar after work, Peter remains at his desk to study the data

on the disk. What he discovers totally freaks

him out, and he calls a workmate to insist that he, and Will their Boss come

back to the Office immediately.

Once there they quickly realize that Peter’s discovery

is potentially catastrophic, and so Will calls his boss Sam, who in turns calls

Jared the CEO, who the informs John Tuld the Chairmen who immediately flies in

by helicopter to take control of the situation.

It is now almost 4 am in the morning, and the Chairmen

surrounded by all the Senior partners,

demands that Paul tell him exactly what all the fuss is about, and he

insists that he does it in plain simple English so that he can grasp the

situation. His job he stresses is to

manage the Corporation, but not necessarily understand its business.

Essentially the mortgage-based securities that they

have been holding as part of a complicated moneymaking scheme have lost so much

of their value they could bring the Company down in one foul swoop. There is not a moment to lose if it is to survive. It is up to the Chairman to make the margin call. In other words to order his Company to start

dumping these worthless holdings before the truth gets out, even if this means

completely betraying their customers. He

doesn’t hesitate for a single moment, as he decides that his is their survival

plan and that he will also find a scapegoat to take the blame. He is unshakably

ruthless and without feeling for people, and just keeps repeating, there is

no choice.

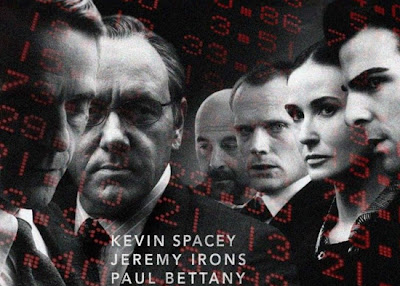

This wonderfully tense thriller unfolds at a sharp

fast pace, and even if like the Chairmen you don't get all the minute detail,

you know that you are witnessing a potentially major disaster. The total disregard for human casualties is frightening

and made compellingly believable by a stellar cast who convincingly mastered

all the financial jargon. The cool hard

Chairman is brilliant portrayed by Jeremy Irons , and is joined by fellow Brits Paul Bettany

as Will the chancer of a Floor Supervisor, and Simon Baker as the young steely

CEO. Sam is played by Kevin Spacey looking very much his age but showing what a

fine actir he used to be too, Demi Moore was the token women excecutve, and the junior analyst who disvoevred it all was played Zachary Quinto, a refreshing discovery

himself. And this highly polished movie was most surprisingly the debut of writer/director J.C. Chandler.

As much as a I hated what was going down in the story, I

really loved this tale of corporate greed that knows no bounds. It had me totally hooked, as well as putting my last

few dollar bills tucked safely away under my my mattress.

★★★★★★★★